Stablecoin Shuffle — Terra Fiasco Shakes up Fiat-Pegged Crypto Economy, Over $35 Billion Disappears – Bitcoin News

3 min read

According to insights on Friday, May 13, the top stablecoins by market capitalization are as of now worth $163.7 billion after the stablecoin economy was esteemed at near $200 billion simply last week. Obviously, the climactic terrausd (UST) disappointment cleared out billions off of the stablecoin economy, and Binance’s stablecoin BUSD has as of late entered the main ten crypto market capitalization positions. Similarly as it caused bloodletting in the crypto economy, Terra’s new destruction has caused an extraordinary shift inside the stablecoin ecosystem.

The Stablecoin Economy’s Great Shift

It was just seven days prior when the stablecoin economy was terribly near outperforming the $200 billion imprint, however Terra’s new breakdown changed all that. Land’s once steady token terrausd (UST) was once the third-biggest stablecoin in presence until it lost its $1 equality. The symbolic that should be fixed to a U.S. dollar’s worth is presently exchanging for under $0.20 per unit. In any case, the market valuation makes it the 6th biggest market cap in coingecko.com’s “Stablecoins by Market Capitalization” list.

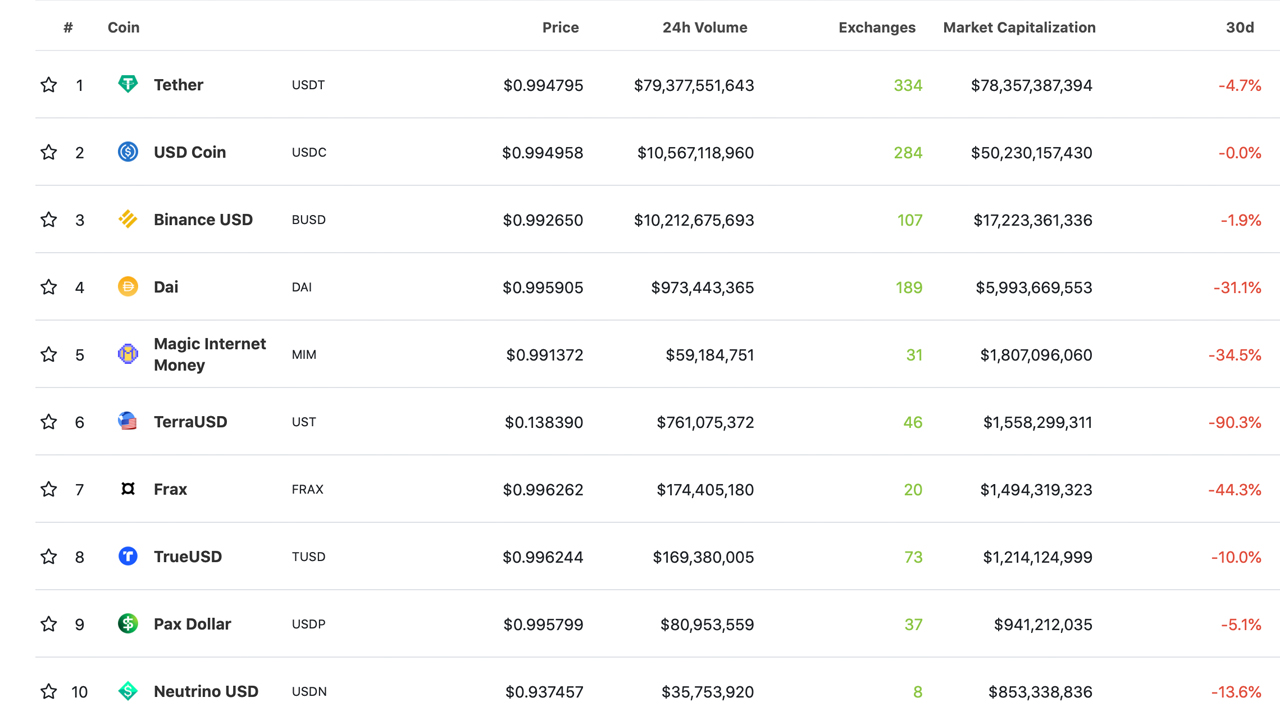

The top ten stablecoin tokens by market capitalization as indicated by coingecko.com’s measurements on May 13, 2022 at 2:00 p.m. (ET). Coingecko takes note of that “UST has remained de-pegged from the U.S. dollar since 9th May 2022.”

The top ten stablecoin tokens by market capitalization as indicated by coingecko.com’s measurements on May 13, 2022 at 2:00 p.m. (ET). Coingecko takes note of that “UST has remained de-pegged from the U.S. dollar since 9th May 2022.”

During the last month, out of the main ten stablecoins by market valuation, none of the stablecoin projects saw development. USDC plunged by 0% throughout recent days, while the wide range of various top stablecoins saw 30-day declines. BUSD is currently the third-biggest stablecoin token today with a $17.3 billion market capitalization and BUSD has likewise ventured into the main ten crypto coins by market cap, taking the 10th situation among 13,000+ coins.

Makerdao’s DAI token is presently the fourth-biggest stablecoin market capitalization with $6 billion today. Makerdao’s local token MKR hopped 15% in esteem during the beyond 24 hours taking on a portion of UST’s aftermath. As a matter of fact, the vast majority of the stablecoins that have figured out how to stay stable and have received the rewards of UST’s crash.

While Some See the Need for ‘More Regulatory Framework’ Around Fiat-Pegged Coins, Some Believe a Decentralized Stablecoin Is Still Needed

On May 12, 2022, Circle Financial’s CEO Jeremy Allaire tweeted: “USDC/USDT is the trade of the day. Flight to quality.” The Circle chief appeared on CNBC’s transmission “Squawk Box,” and noticed that there should be “more regulatory framework around stablecoins.” various individuals have been watching the presentation of alleged decentralized and algorithmic stablecoins very intently since Terra’s downfall.

Despite the new Terra UST bloodletting, many actually trust there’s an extraordinary requirement for decentralized and algorithmic stablecoins among the concentrated monsters. Torrential slide (AVAX) pioneer Emin Gün Sirer accepts the crypto biological system needs a decentralized stablecoin.

A day before LUNA went under a U.S. penny, Gün Sirer said: “Even fully-collateralized fiat stablecoins have de-pegged. Even some of the weak [algorithmic] stablecoins have recovered.” The AVAX organizer additionally stated that he had “always said that [algorithmic] stables are subject to destabilizing bank runs.” Despite the bank run risk, Gün Sirer made sense of that a decentralized stablecoin is as yet required in the industry.

“We need a decentralized stablecoin,” Gün Sirer point by point. “Fiat-backed stables are subject to legal seizure and capture. A decentralized economy needs a decentralized stablecoin whose backing store cannot be frozen or confiscated.”

Labels in this story

Torrential slide Founder, AVAX Founder, BUSD, Capitalizations, Circle CEO, crypto economy, Cryptocurrency, DAI, Digital Currencies, Emin Gün Sirer, fiat-fixed tokens, Jeremy Allaire, makerdao, Market Capitalizations, market positions, MKR, stablecoin resources, Stablecoins, TerraUSD, Tether, Top Ten, top ten competitors, usd coin, USDC, UST

What is your take on the stablecoin economy mix this week? Tell us your opinion regarding this matter in the remarks segment below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

More Popular News

In Case You Missed It

Source link

#Stablecoin #Shuffle #Terra #Fiasco #Shakes #FiatPegged #Crypto #Economy #Billion #Disappears #Bitcoin #News