Top 5 Bitcoin IRA Companies: 5 things to be aware prior to Investing

8 min read

#1

#2

#3

#4

#5

‘Regal Assets Logo from regalassets.com’

‘BitCoin IRA Logo from bitcoinirainvestment.com’

‘Retire With Choice Logo from retirewithchoice.com’

‘Trust ETC Logo from trustetc.com’

‘iTrust CapitaLogo from itrustcapital.com’

Website: Regal Assets Bitcoin IRA Choice Equity Trust iTrust Capital HQ: Los Angeles, CA Los Angeles, CA Murray, KY West Lake, OH Irvine, OH Fees: $250 Annual level expense, first year postponed. Exchanging expenses on demand. $240 Annually. Once arrangement charge of 10-15% of beginning speculation. 1-5% exchanging expenses. 1% Annual stockpiling. $500 arrangement + $10 every month for private keys. $70 Annually. $50 One-time Fee. 1% exchanging expenses. Years in Business: 13 5 11 47 3 24hr Account Set up?

✅

❌

❌

❌

❌

Insured?

✅

✅

✅

✅

✅

‘Summary table by Jules Blundell’

Best Bitcoin IRA Provider Overall: Regal Assets regalassets.com Best for Crypto Staking: Bitcoin IRA Best for Range of Alternative Assets: Equity Trust Best for Smartphone App: Choice and iTrust Capital

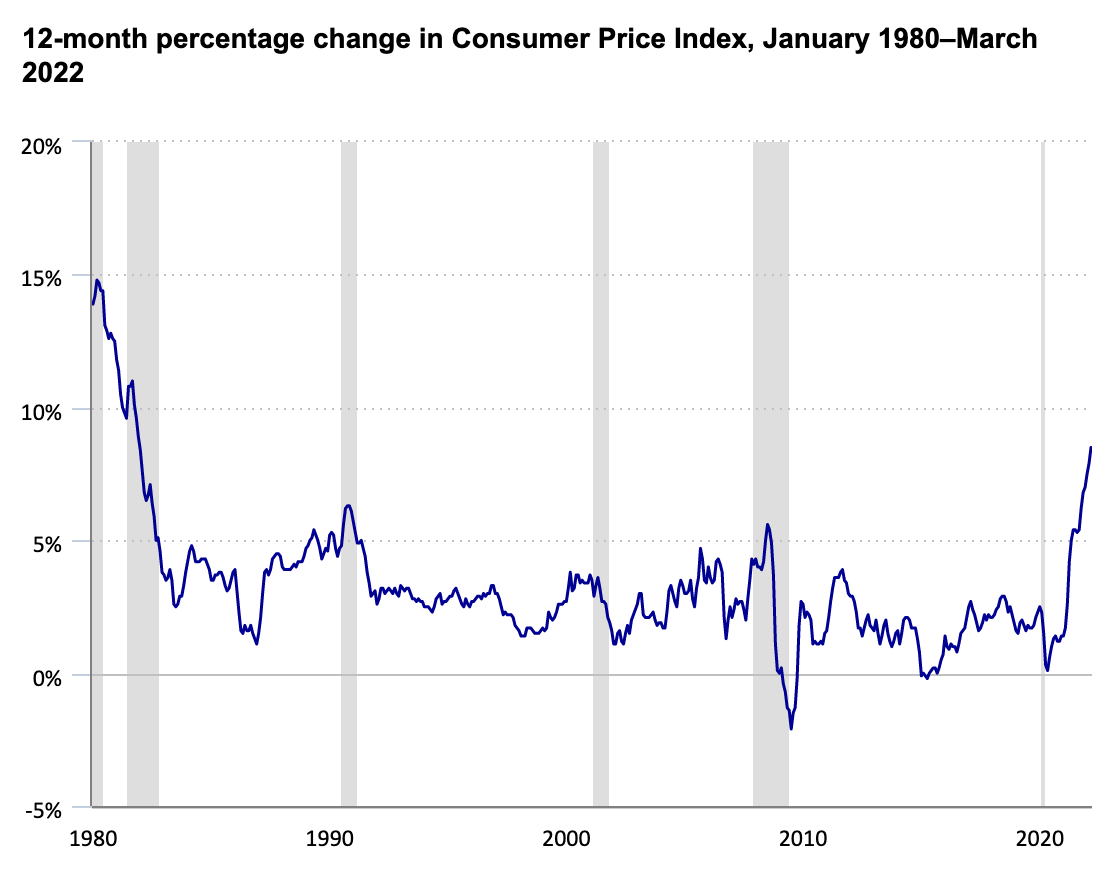

Retirement financial backers deal with a major issue at this moment: what to do about inflation?

The 8.5% year-on-year expansion in the US Consumer Price Index for March 2022 was the greatest development in 41 years.

Source: U.S. Bureau of Labor Statistics

If you are reserving money to subsidize your retirement, cost expansion implies that the genuine worth of your money reduces. On the off chance that you simply set aside in money, you are developing a heap that is continually being eaten away.

This is the reason watchful financial backers put something aside for their retirement utilizing different resources: stocks, ETFs, land, and actual valuable metals like gold and silver. What’s more, presently the most recent youngster on the square is crypto, and explicitly Bitcoin.

With a market capitalization of nearly $800bn, Bitcoin claims more than 40% of the whole crypto area. Bitcoin outperformed both the gold and the financial exchange for the third year running in 2021. Bitcoin isn’t dependent upon deflationary strain (like money), in light of the fact that the stock of Bitcoin is covered at 210m coins. What’s more, other cryptos are comparably protected.

A key gamble with crypto, however, is instability: costs go all over quickly. Cash is undeniably less unstable. Furthermore, the eventual fate of the whole crypto area is unsure: everything relies upon what sovereign controllers choose. In spite of the fact that it is impossible, you could observe that your Bitcoin speculation is worth short of what you paid for it when you retire.

These are gambles, nonetheless, that numerous retirement financial backers are able to take.

“So far as retirement accounts go, right now, with bitcoin, it’s IRAs, IRAs, IRAs,” explained Onramp Invest CEO Tyrone Ross to CNBC.com in 2021.

1: How does a Bitcoin IRA work?

A Bitcoin IRA is a type of independently managed IRA (SDIRA).

If you are under 50, the IRS allows you to invest up to $6,000 in an SDIRA consistently. Over the age of 50, as far as possible is $7,000. SDIRAs permit you to put resources into a scope of assets.

A ‘Bitcoin IRA’ is the name given to SDIRAs which permit you to put resources into Bitcoin and other cryptos. Most 401k retirement accounts don’t permit you to put resources into crypto.

A key benefit of a SDIRA is that you won’t pay personal assessment on any cash you put resources into it. Furthermore, in the event that you select Roth IRA, you won’t pay charge on any benefits you make. (Roth IRAs don’t exactly measure up for all incomes).

A key necessity of any IRA is that there is a legitimate ‘custodian’ who manages it. Despite the fact that financial backers get to deal with their IRA speculations themselves, they need to do as such through an organization that offers a custodianship administration (here are five top Bitcoin IRA companies reviewed).

2: What are the advantages of a Bitcoin IRA?

Reduce your duty bill right now

The cash you put resources into a Bitcoin IRA is removed your available pay for the year.

Legally try not to pay charge on crypto profits

If you have a Roth IRA, you won’t pay charge when you take a ‘distribution’ (ie. sell your crypto and discharge it to cash). In the event that you exchange crypto beyond an IRA, you will be supposed to pay capital additions charge on any profits.

Hedge against inflation

The supply of most crypto is covered. The inventory of government issued types of money (ie. cash) isn’t covered. This implies that state run administrations can print more cash, and the worth of that money is diminished. This isn’t an issue with crypto.

Get in on the crypto sector

If you give a little piece of your IRA stipend to a Bitcoin IRA, you can dependably put resources into a key unique speculation class.

Manage crypto volatility

Bitcoin IRA accounts like that presented by Regal Assets, for instance, urge you to HODL your crypto (that implies ‘Hold On for Dear Life). The idea of a ‘stash-and-hold’ account is to purchase crypto and hold it for quite a long time, braving transient volatility.

The risk remains, notwithstanding, that the cost of any crypto could decrease over the long run as opposed to rise; however with cash, for instance, that is a conviction now and again of excessive cost inflation.

No need to set up a crypto wallet

Using a Bitcoin IRA implies you can keep away from the problem of setting up a crypto wallet to exchange crypto.

3: What are the advantages of putting resources into cryptocurrency?

Cryptocurrencies could well be the greatest thing to at any point occur throughout the entire existence of finance.

One key thought of crypto is that no one controls the stockpile of cash, and that implies the framework is fair. Crypto is likewise programmable cash. This implies the universe of money, actually, has another toy to play with; the conceivable outcomes are huge, similar to the rewards.

When you put resources into a crypto, you don’t need to utilize that crypto as a cash. You can simply regard it as an investment.

Backing crypto implies backing the future of ‘DeFi’ – Decentralized Finance.

DeFi crypto as of now has a joined market capitalization of more than $100bn.

Increasing backing by ‘TradFi’

‘TradFi’ implies ‘Traditional Finance’. That implies the huge banks.

TradFi, similar to states, has been dubious of DeFi, not least on the grounds that DeFi removes the enormous banks of exchange fees.

But TradFi is progressively attempting to get in on the crypto scene. 80% of worldwide national banks are investigating setting up advanced monetary forms. The US Federal Reserve is investigating the chance of a completely digitized US dollar. You can as of now get many ‘stable coin’ crypto that is fixed to the worth of the US dollar.

85% of abundance directors from large speculation houses surveyed independently across Europe said in 2021 that they wanted to expand their crypto holdings.

A ongoing overview of US monetary counselors found that crypto is becoming undeniably more adequate in individual accounting circles as well. The 2021 Trends in Investing report from the Financial Planning Association shows that 14% of individual consultants presently prescribe crypto to their clients, contrasted with only 1% in 2020.

Increasing support by governments

National state run administrations have generally been dubious of crypto. They have expected that the decentralized idea of crypto implied that residents could utilize crypto to try not to cover charges. Another dread has been that extortion and digital robbery presently can’t seem to be removed from the crypto sector.

As an outcome, certain crypto trades have been restricted from the US and China.

But, as the quantity of crypto enlarges to very nearly 19,000, the specialists are coming near. Toward the start of the Ukraine emergency, the US state of Colorado announced that it would start to acknowledge crypto for charge installments. Furthermore, we should not fail to remember that a whole country, El Salvador, made Bitcoin legitimate delicate last year. 80% of national banks are investigating making advanced monetary forms, including the Federal Reserve of the US.

4: Is putting resources into digital money appropriate for me?

Crypto is a high-risk/high-reward speculation. Crypto isn’t even lawful delicate in the US. What’s more, the reality of it is that, assuming sovereign controllers choose crypto is excessively hazardous, they could prohibit it completely.

That is the reason it is indispensable to be clear about your own gamble profile.

If you are putting something aside for retirement, almost certainly, you would rather not face such a large number of challenges: your life investment funds are in question all things considered. However, you likely don’t have any desire to pass up the high development capability of crypto either.

A reasonable methodology, then, at that point, is to contribute a little piece of your SDIRA stipend into a Bitcoin IRA. Put the rest in lower-risk resources like stocks, land, and even money. Furthermore, we should not disregard gold…

Diversify with valuable metals

Whereas crypto is a high-risk/high-reward speculation, the valuable metal gold is a generally safe/low-reward venture. Gold is viewed as a safe house now and again of expansion. Numerous financial backers, thusly, decide to oversee risk by putting resources into both crypto and valuable metals including gold.

Many Bitcoin IRA suppliers including Regal Assets permit crypto devotees to likewise put resources into valuable metals utilizing a similar IRA. Or on the other hand they give a different IRA, called a gold IRA or a silver IRA.

5: What organizations could I at any point use to run a Bitcoin IRA?

Below we investigate five top suppliers of Bitcoin/crypto IRAs. We propose you look at however many suppliers as you can prior to committing any funds.

We suggest California-based supplier Regal Assets as a decent spot to begin: Regal Assets has a superb name in the IRA business and offers a straightforward level yearly charge as well as top security and crypto purchasing choices. With Regal, you can likewise put resources into actual gold and have it put away for you in an IRS-endorsed depository.

Best Bitcoin IRA Provider Overall: Regal Assetsregalassets.com Best for Crypto Staking: Bitcoin IRA Best for Range of Alternative Assets: Equity Trust Best for Smartphone App: Choice and iTrust Capital

#1 Regal Assets – Best Bitcoin IRA Provider Overall

Homepage: www.regalassets.com

Phone: 877-205-1104

Bitcoin IRA as it were? Crypto, valuable metals and stocks

Years in Business: 13

Smartphone application? No

A large strength of Regal Assets is that the California-based firm is an across the board IRA supplier. That implies financial backers can deal with their crypto IRA as well as exchange crypto under Regal’s one rooftop. The Regal IRA is supervised by respectable overseer Kingdom Trust, which is controlled by the South Dakota Division of Banking.

With the Regal IRA, financial backers can stash crypto, valuable metals, and stocks. You can pick whichever resources you like, in whatever extent. As Regal CEO Tyler Gallagher affirms, with Regal, everything without question revolves around decision: “clients make all the decisions themselves when it comes to digital asset selections and allocation, but do have the option of guidance by connecting with their dedicated account manager.”

Best of all, with Regal Assets, you can get your IRA set up day in and day out on the web. You can then look over a developing scope of 25+ crypto, with high-security crypto cold capacity as standard. Protection cover is given by Lloyds of London. The firm offers further heavyweight qualifications with CEO Gallagher being a Forbes Finance Council Member.

Pros:

✅ AAA rating from the Business Consumer Alliance

✅ Flat charge structure ($250 a year)

�