Traders develop cautious of ‘unloved’ bitcoin rally

4 min read

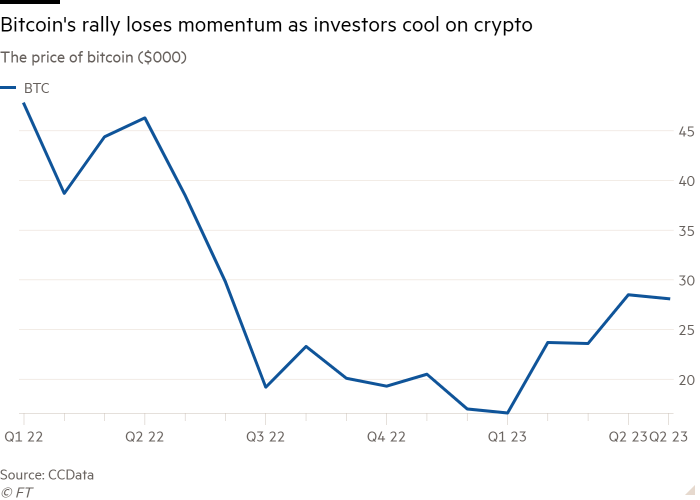

Cryptocurrency buying and selling exercise has dwindled whilst bitcoin enjoys its longest profitable streak in additional than two years, in an indication that many buyers are more and more reluctant to purchase into the rebound after a string of collapses and scandals in 2022.

The worth of bitcoin, the most well-liked token, has risen 70 per cent this 12 months, serving to the market regain some momentum following the failure of firms like change FTX.

Traders have shrugged off lawsuits from US regulators towards firms resembling Binance, the trade’s largest change, and the collapsed stablecoin operator Terraform Labs, as authorities have sought to clamp down on exercise they see as unlawful.

Nevertheless, the worth of bitcoin has since been caught in a rut for greater than a month, buying and selling in a slender vary round $28,000. That pause has been accompanied by thinning volumes, with small trades more and more in a position to transfer market costs.

“While bitcoin’s recent performance is great on the face of it, many in crypto are calling this year an unloved rally,” stated Charles Storry, head of development at Phuture, a crypto index supplier.

“Sentiment hasn’t changed, and regulatory scrutiny is sidelining a lot of new money that might otherwise enter the space. Price movements don’t mean much if the industry isn’t making meaningful progress to regain trust and attract new investors,” he added.

A bruising 2022 has left buyers nursing losses or funds trapped in limbo as failed cryptocurrency lenders and exchanges undergo chapter proceedings within the courts.

Crypto fanatics additionally argued confidence has been renewed by the weak spot within the world banking sector, and the huge outflow of deposits from banks such because the US’s Silicon Valley Financial institution and Silvergate, and Credit score Suisse in Switzerland.

Digital property dashboard

Click on here for real-time knowledge on crypto costs and insights

“That rally we experienced after the banking crisis earlier this year seemed to be directly related to a flight for safety and self-custody of funds away from the dollar,” stated Edmond Goh, head of buying and selling at crypto dealer B2C2.

However that sentiment has been undermined by a bunch of alerts coming from crypto markets. Analysts level out that the rally in cryptocurrency costs was already constructed on a thinly traded market.

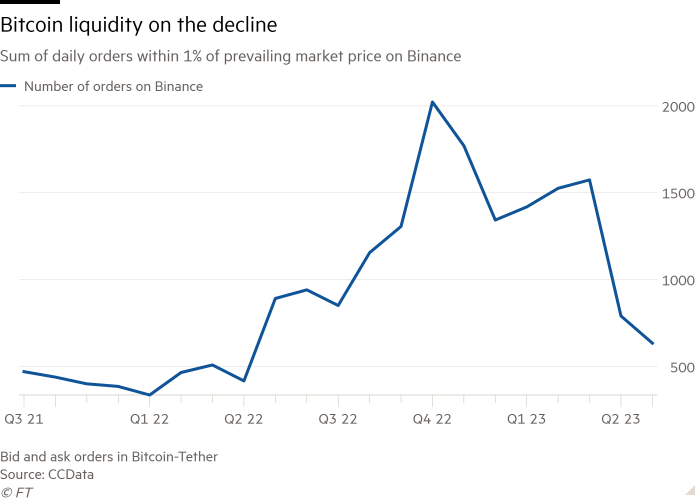

The diploma to which a market can take in massive orders with out main adjustments to the worth of bitcoin has declined for the reason that begin of the 12 months, in line with knowledge supplier CCData.

In January it might have required the acquisition of greater than 1,400 bitcoins, roughly equal to $23mn on the time, to maneuver the worth of the token by greater than 1 per cent of its prevailing market worth, CCData stated.

In the direction of the top of final month it might have taken solely 462 bitcoins, price about $13mn, to maneuver market costs by 1 per cent, the bottom level of market depth for the bitcoin-tether buying and selling pair since Might 2022, when the trade plunged into disaster.

“Prices are recovering, but liquidity has yet to return. No exchange or market maker has yet to fill the space that FTX and [its sister trading arm] Alameda once encompassed,” stated Michael Safai, managing companion at crypto buying and selling agency Dexterity Capital.

Traders who’ve purchased into bitcoin in current months are actually holding on to their investments.

Glassnode, a crypto knowledge supplier, stated “there has been remarkably little expenditure” by buyers who purchased bitcoin when it hit a two-year low after FTX’s failure final November.

“The ‘FOMO’ that drove a lot of first time institutional and retail investors last year is obviously not happening now, despite the fact the crypto markets have rallied significantly this year,” stated one crypto fund supervisor primarily based in Dubai, referring to a worry of lacking out.

Furthermore, there have been outflows of $72mn over the past two weeks in digital asset investments, ending a six-week run of consecutive inflows, in line with CoinShares. The crypto funding group ascribed the development to the likeliness of additional rate of interest will increase by the US Federal Reserve.

Traders are additionally fearful that the heavy clouds which have overshadowed the trade for the previous 12 months haven’t totally gone away. Binance, the world’s largest crypto change, is prone to be pulled right into a drawn-out lawsuit with the Securities and Trade Fee.

One other cloud is the destiny of Genesis, one of many greatest lenders within the crypto market, which filed for chapter in January owing greater than $3bn after the implosion of FTX.

Proprietor Digital Foreign money Group, one of many world’s largest proprietor of bitcoins through its asset administration arm, is seeking to elevate funds to pay again Genesis collectors. DCG stated last week some Genesis collectors had walked away from a beforehand agreed restructuring deal.

The market seems to be “in a holding pattern pending the resolution of DCG’s debt payments”, stated Ram Ahluwalia, chief government of funding adviser Lumida Wealth Administration.

The uncertainty, together with the disaster within the US regional banking trade, has underscored for a lot of that the market continues to be working via its many points.

“There still isn’t a lot of organic momentum behind cryptocurrencies,” stated Safai. “The headline events that propel cryptocurrency prices past sticking points . . are few and far between.”

Click here to go to Digital Asset dashboard

Source link

#Traders #develop #cautious #unloved #bitcoin #rally