‘Trading Like a Lehman Moment’ — Credit Suisse, Deutsche Bank Suffer From Distressed Valuations because the Banks’ Credit Default Insurance Nears 2008 Levels – Economics Bitcoin News

5 min read

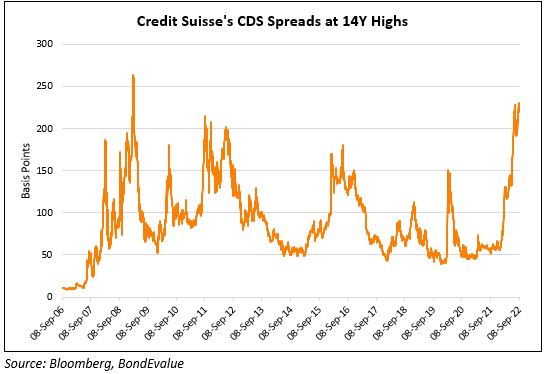

It’s been greater than a decade for the reason that monetary disaster in 2007-2008 when Lehman Brothers, the fourth largest funding financial institution within the U.S., collapsed and filed chapter. Near 14 years later, Credit Suisse and Deutsche Bank, two of the world’s largest banks, are affected by distressed valuations and the banks’ credit score default insurance coverage ranges are approaching levels not seen since 2008.

Credit Suisse and Deutsche Bank Valuations Have Dive-Bombed — Buyers Talk about the Systemic Danger to the World Financial system

In the course of the first week of October, the world economic system continues to look bleak as power and gasoline costs have reached file highs, inflation in lots of international locations is the very best in 40 years, provide chains are fractured, fairness markets have shed vital worth, and the tensions between the West and Russia has elevated.

Amid this nasty economic system, two of the most important funding banks are floundering from distressed valuations. Market data reveals that Credit Suisse Group AG (NYSE: CS) and Deutsche Bank AG (NYSE: DB) are buying and selling at extraordinarily low values not seen for the reason that 2008 monetary disaster.

On the finish of August, Deutsche Bank analyzed the problems tethered to Credit Suisse, and the financial institution’s analysts famous that there was a $4.1 billion gap that must be stuffed with a purpose to fight the monetary establishment’s monetary well-being. Moreover, Credit Suisse’s credit score default insurance coverage (CDS) ranges resemble the identical CDS ranges Lehman Brothers had simply earlier than the financial institution’s chapter.

Credit Suisse CEO Ulrich Koerner lately explained that his firm is dealing with a “critical moment” and he pressured that the Swiss-based monetary establishment has a “strong capital base and liquidity position.”

Massive Investor Says Credit Suisse CDS Is Trading Like a ‘Lehman Moment,’ Wallstformainst CEO Says ‘Anyone Who Fully Trusts Credit Suisse’s accounting Additionally Believes in Unicorns and the Tooth Fairy’

Not everybody agrees with Koerner as a report from investing.com particulars {that a} “large investor that deals with Credit Suisse says the investment bank is a disaster, [and] CDS is trading like a ‘Lehman moment’ [is] about to hit.” The managing companion at Compcircle Gurmeet Chadha, nevertheless, doesnt suppose a serious market anomaly will reveal itself.

“Since 2008, once a year Credit Suisse [and] once in [two] years Deutsche bank is about to default,” Chadha tweeted. “In Every correction – this speculation starts coming. In my little experience- A black swan event never announces itself.”

Credit Suisse analysts downgrading their very own inventory to a promote ranking pic.twitter.com/SghqtoFnhS

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 2, 2022

Chadha’s commentary has not put a cork on the hypothesis surrounding the 2 banks and lots of consider a catastrophe is imminent. “Credit Suisse is probably going bankrupt,” the Twitter account ‘Wall Street Silver’ told its 320,000 followers.

“The collapse in Credit Suisse’s share price is of great concern,” Wall Road Silver mentioned. “From $14.90 in Feb 2021, to $3.90 currently. And with P/B=0.22, markets are saying it’s insolvent and probably bust.”

Credit Suisse, the 4 key numbers:

160b Money

400b at name Liabilities

900b Leveraged publicity

40b Fairness

— Charlie Munger Followers (@CharlieMunger00) October 1, 2022

An analysis of the scenario revealed on Searching for Alpha additionally notes that each Credit Suisse and Deutsche Bank are buying and selling at distressed valuations and additional says that Credit Suisse “will have to go through a painful restructure.” The Searching for Alpha creator writes that “[Credit Suisse] is trading at 0.23x tangible book [and] Deutsche Bank is trading at 0.3x tangible book value.” Nevertheless, the Searching for Alpha creator says that Deutsche Bank is working by way of the storm by way of advantages from rates of interest. The creator provides

Buyers ought to keep away from [Credit Suisse] and purchase [Deutsche Bank].

Buyers consider that the 2 monetary giants are dealing with a major disaster they usually don’t consider the statements made by the Credit Suisse CEO. Some have criticized the banks’ auditing course of as they consider Credit Suisse and Deutsche Bank are up to their necks in debt and unhealthy loans.

“Tell me the real number amount of bad loans outstanding that Credit Suisse has to these hedge funds and family offices like Archegos,” the CEO of Wallstformainst Jason Burack tweeted in August. “Because anyone who fully trusts their accounting also believes in unicorns and the tooth fairy.” On the time of writing, the time period “Credit Suisse” is a really popular vertical trend on Twitter on Sunday morning (ET) with 46,000 tweets.

Tags on this story

2007-2008 disaster, 2008 Monetary Disaster, CDS, CDS insurance coverage, credit score default swap (CDS), credit score suisse, Credit Suisse CDS, Deutsche Bank, Deutsche Bank points, distressed valuations, power costs, Monetary Points, gasoline costs, World Financial system, Gurmeet Chadha, inflation, Insurance, Jason Burack, Market Knowledge, NYSE: CS, NYSE: DB, Searching for Alpha, Ukraine-Russia warfare, Wall Road Silver, Wallstformainst

What do you consider the monetary points surrounding Deutsche Bank and Credit Suisse? Tell us what you consider this topic within the feedback part beneath.

![]()

Jamie Redman

Picture Credits: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: Nataly Reinch and Rostislav Ageev

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

Extra In style News

In Case You Missed It

Source link

#Trading #Lehman #Moment #Credit #Suisse #Deutsche #Bank #Suffer #Distressed #Valuations #Banks #Credit #Default #Insurance #Nears #Levels #Economics #Bitcoin #News