Pro-crypto Majority Whip Tom Emmer denounces CBDCs as a ‘surveillance tool’ and calls for stablecoin oversight

3 min read

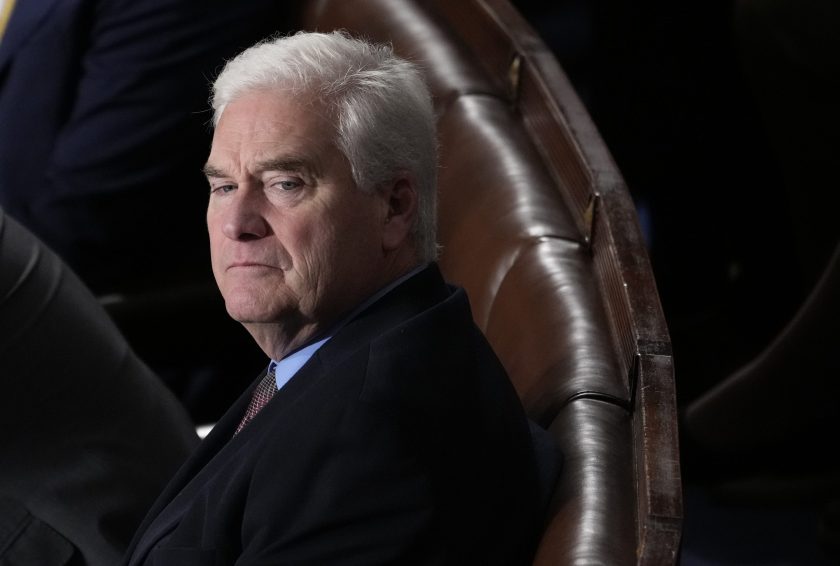

House Majority Whip Rep. Tom Emmer (R-Minn.). Drew Angerer—Getty Images

House Majority Whip Tom Emmer (R-Minn.) continued his pro-crypto crusade on Thursday, denouncing recent efforts by the executive branch to wrangle the wildcat industry.

Speaking at a policy summit in Washington, D.C., hosted by the Blockchain Association, one of the sector’s leading trade groups, Emmer reiterated his opposition to central bank digital currencies, or CBDCs, just one day after Treasury Deputy Secretary Wally Adeyemo appeared at the conference to call for more oversight tools.

“The central bank digital currency is nothing more than a surveillance tool,” Emmer said in a fireside chat moderated by Marco Santori, chief legal officer for the crypto exchange Kraken. “This is a very dangerous slope that we’re going down.”

Emmer sits on the House Financial Services Committee, which has led a push for crypto legislation as Congress continues to debate regulation. Along with supporting two bills that would establish frameworks for stablecoin and market structure oversight, Emmer sponsored another that prevents the government from issuing a CBDC. That bill passed out of his committee in September. Emmer said on Thursday that he hopes it gets a full floor vote soon, although he expressed skepticism President Joe Biden would sign it.

Speaking at a financial technology conference in early November, Michael Barr, the Federal Reserve vice chair for supervision, said the central bank still has not decided on whether a CBDC would be a “good idea” and that it would only move forward with a consumer-focused application if the Fed had clear authorization from both Congress and the executive branch.

‘Self-proclaimed savior’

A more pressing question for crypto advocates in Congress is a new proposal by the Treasury Department that would expand its oversight tools over stablecoins and illicit finance powered through digital assets.

As Congress waffles on passing its own legislation, Emmer warned that increased supervision by Treasury could “swallow up” crypto into the “surveillance security state.”

“Beware of the self-proclaimed savior that rides in on the white horse and tells you, ‘I’m here to protect you,’” Emmer said.

Despite the disagreement between regulators and pro-crypto legislators over how to implement supervision, both sides seem to be circling the same issue: the rise of Tether, a dollar-backed stablecoin that exists outside of U.S. jurisdiction. While not explicitly naming Tether, the new Treasury proposal would expand the department’s oversight to any dollar-backed stablecoins—even those operating outside the country.

Tether has risen to a market cap of nearly $90 billion at the expense of peer USDC, which is managed by the U.S.-domiciled crypto firm Circle. In a June report, the blockchain analytics firm TRM Labs found that illicit actors are increasingly turning to Tether issued on the blockchain Tron for financing.

‘A level playing field’

Speaking to Fortune outside of the summit, Emmer said that the rise of Tether is “one of the reasons I’m worried about what this government is doing.”

“We need to have this stuff here,” Emmer said. “And you do that by creating a level playing field that people understand what the rules are.”

A frequent critic of Securities and Exchange Commission Chair Gary Gensler, Emmer added that the SEC has a record of ignoring bad actors—or not recognizing them. Gensler once took a meeting with Sam Bankman-Fried and a group of crypto executives who were seeking an SEC-approved trading platform.

The agency, Emmer added, was “doing business with FTX while FTX is bilking people out of money in the oldest financial scheme known to mankind.”

Source link

#Procrypto #Majority #Whip #Tom #Emmer #denounces #CBDCs #surveillance #tool #calls #stablecoin #oversight