Bitcoin, Ethereum And Dogecoin Provide Trade For Bulls And Bears As This Key Trend Confirms | Benzinga

3 min read

Bitcoin (CRYPTO: BTC), Ethereum (CRYPTO: ETH) and Dogecoin (CRYPTO: DOGE) are on the whole exchanging higher in solid upswings. An upswing happens when a stock reliably causes a progression of new records all around on the chart.

The better upsides to show the bulls are in charge, while the irregular more promising low points demonstrate solidification periods. Dealers can utilize moving midpoints to help distinguish an upswing, with rising below moving midpoints (like the eight-day or 21-day outstanding moving midpoints) demonstrating the stock is in a precarious more limited term upturn and rising longer-term moving midpoints (like the 200-day basic moving normal) showing a drawn out uptrend.

A stock frequently flags when the higher high is in by printing an inversion candle, for example, a doji, negative overwhelming or hanging man candle. In like manner, the higher low could be flagged when a doji, morning star or sledge candle is printed. Besides, the new records all around frequently happen at opposition and backing levels.

In an upswing the “trend is your friend” until it’s not, and in an upturn there are ways for both bullish and negative merchants to take part in the stock:

Bullish merchants who are as of now standing firm on a footing in a stock can feel sure the upturn will proceed with except if the stock makes a lower low. Dealers hoping to take a situation in a stock exchanging an upturn can for the most part track down the most secure section on the higher low.

Negative brokers can enter the exchange on the higher high and exit on the pullback. These dealers can likewise enter when the upswing breaks and the stock makes a lower low, showing an inversion into a downtrend might be possible.

See Also: Ethereum Classic Soars On Reaction To Key Pattern, Miners Gain Interest: Is A Golden Cross On The Way?

The Bitcoin Chart: Bitcoin switched into an upswing on March 14 and March 16, the crypto separated from a sliding channel design on the everyday diagram. The latest higher low was imprinted on March 18 at $40,130 and if the crypto keeps on exchanging over the level the upswing will remain intact.

On Sunday, Bitcoin appeared to print one more higher low under an opposition level at $42,223. Merchants and financial backers can look for the crypto to hold over the eight-day dramatic moving normal (EMA) on the pullback for certainty going ahead.

The retracement on Sunday was being made on below the norm volume, which is a positive sign for the bulls. By late evening, Bitcoin’s volume was estimating in at around 6,075 contrasted with the normal 10-day volume of 15,176. At the point when a security moves below the norm volume, it shows sound solidification is occurring.

Bitcoin has opposition over the $42,223 level at $45,814 and $48,475 and support beneath at $39,600 and $38,105.

Need direct investigation? Observe me in the BZ Pro parlor! Click here for a free trial.

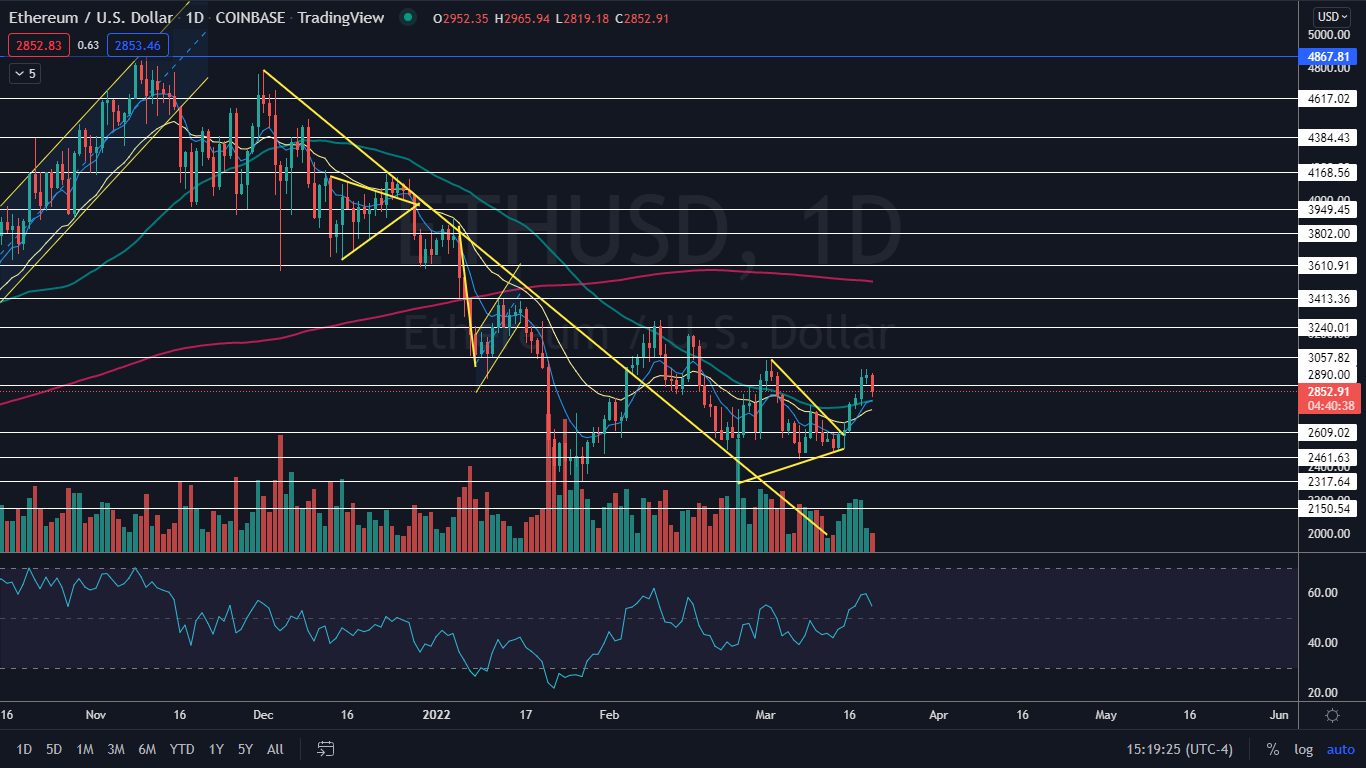

The Ethereum Chart: Like Bitcoin, Ethereum switched into a potential upswing on March 14 and split up from a dropping triangle the next day. Ethereum hasn’t printed a higher low to affirm the trend, but might be currently printing one on Sunday.

Ethereum could likewise be subsiding into a bull banner example on the day to day outline, with the shaft framed between March 14 and March 18 and the banner starting to shape throughout the days from that point forward. The deliberate move of the example, assuming the bull banner is perceived, is around 18%, which demonstrates Ethereum could exchange up toward the $3,300 level.

Ethereum has opposition above at $2,890 and $3,057 and support beneath at $2,609 and $2,461.

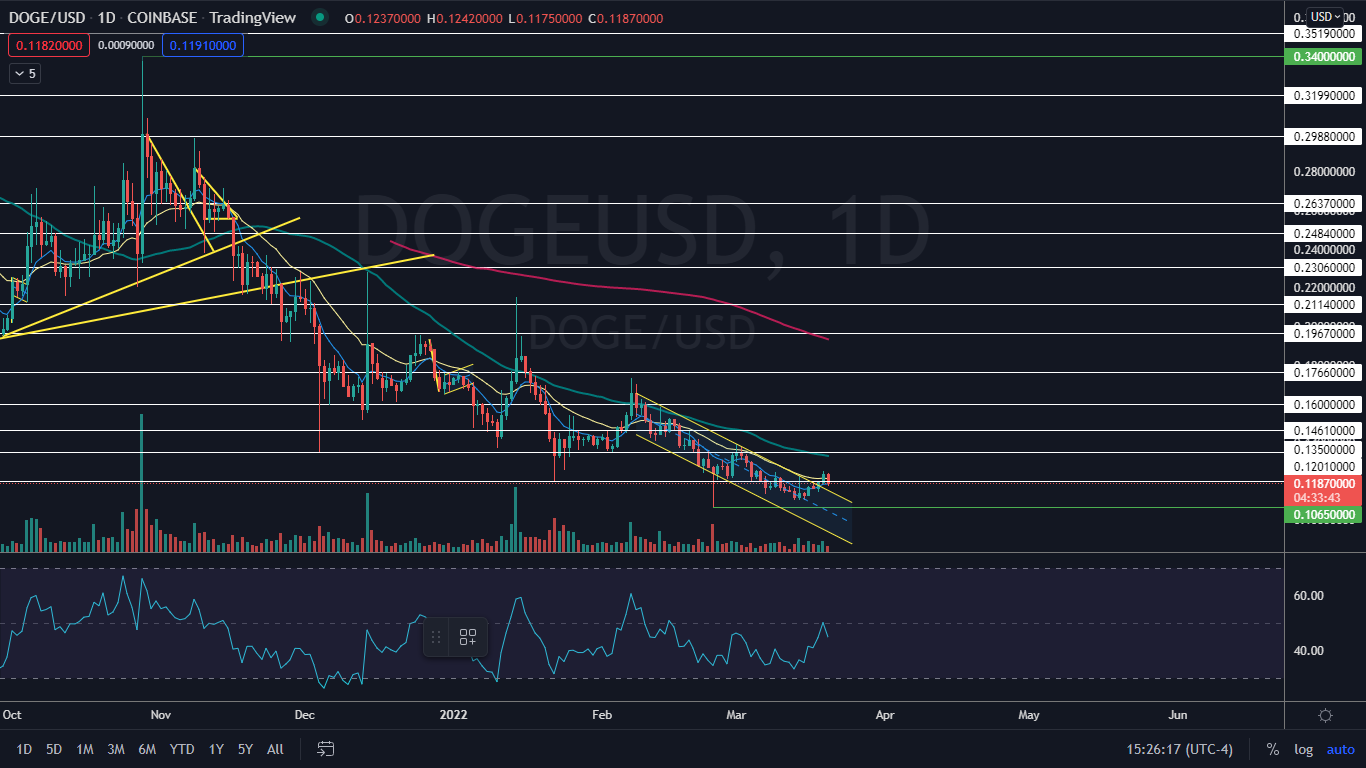

The Dogecoin Chart: Dogecoin switched into an upturn on March 14 and framed its latest higher low at the $0.114 level on Friday, and its latest higher high was imprinted on Saturday at $0.125.

Like Bitcoin and Ethereum, Dogecoin could be printing its next higher low on Sunday. On the other hand, Dogecoin might fall lower on Monday to back test the upper diving trendline of a falling channel design the crypto separated bullishly from on Saturday.

Assuming Dogecoin holds over the example and structures a bullish inversion candle on Monday, it might give merchants who are not currently in a position a strong section point.

Dogecoin has opposition above at $0.135 and $0.146 and support underneath at $0.106 and the significant dime mental level.

Source link

#Bitcoin #Ethereum #Dogecoin #Provide #Trade #Bulls #Bears #Key #Trend #Confirms #Benzinga